There are many uncertainties weighing on the wine market. As a collateral victim of the trade war led by the United States under the Trump era and the unknowns related to the Brexit, its commercial outlets are getting darker. The climate threat is also accelerating. Episodes of drought, frost and hail have never been so numerous. Lastly, consumption, which is subject to trends specific to each country, is an additional unknown. As well as the appearance of “new new world” vineyards that reshuffle the cards of historical vineyards.

However, the market of vineyards is logically indexed on the wine market. Shall Champagne exportations drop and it is the price of the vines that falls. Shall Cognac market blow up and the price per hectare is rising in all the Charentes appellations. The demand for rosé wine is not decreasing ? It is the price per hectare in the Hérault that is soaring.

Before the Covid19 episode, whose dreaded effects are not yet known, what is the price of a vineyard in the french, european and new world vineyards? What are the trends and valuation criteria?

The price of vines in France

With 9,200 transactions in 2019, the French market has never been so dynamic (+5.1% vs 2018). 18,300 hectares of vineyards were exchanged (+8.8% vs 2018) for 987 million euros (+17% vs 2018)! So more vines are being bought, especially the most high-end vines.

The average price of an hectare* of vines in France therefore costs €54,000. But this simple truth doesn’t mean much as there are huge disparities between regions and within the same appellation! Vines classified as PDO are valued at an average of €148,100 per hectare, while those outside the PDO are traded at around €14,400 per hectare.

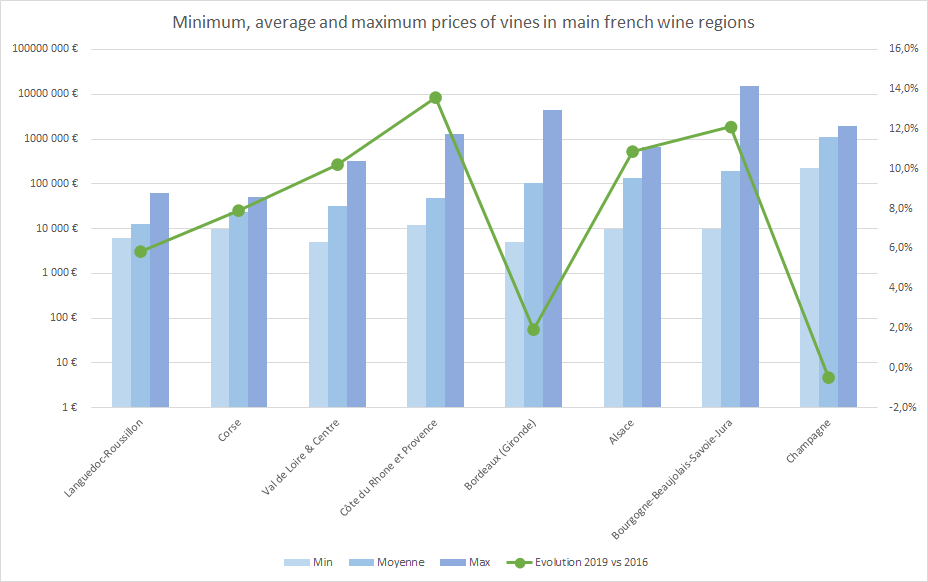

Thanks to the figures published by Safer and put together by Le prix des terres, let’s take a look at the prices per wine region (beware of the visual aspect, the scale is logarithmic!)

It is not surprising that the most prestigious appellations are also the most expensive. However, it is worth noting that after having reached intoxicating heights, prices are marking time in Champagne, a victim of the slowdown in world demand. In Bordeaux, it is the entry-level appellations that are suffering. First victims of the Bordeaux Bashing, they show a decrease of 9% in 2019 compared to 2018! The prestigious appellations remain protected in the image of Margaux and Pauillac, whose prices continue to break historical records.

As for Burgundy, it continues to benefit from the scarcity effect. The vineyard, small in surface (4 times smaller than the Bordeaux vineyard, in planted surface) is characterized by an extremely reduced offer. Here again, the prices of regional appellations are not increasing. It is the Premier Cru and Grand Cru wines that continue to appreciate, pulling the region upwards. Note the surge in prices for parcels of Chablis classified as premier cru in the Yonne (+21% in 2019 compared to 2018).

Whether in Bordeaux, Burgundy, the Rhone or the Loire, the arrival of international investors with unlimited financial means is as much a boon as a risk. A risk of speculative bubble, as the prices seem disproportionate (a grand cru in Burgundy has been valued at more than 15 million euros per hectare!) But also a risk for the transmissions, which become particularly to manage at these prices.

| Min | Average | Max | Evolution 2019 vs 2018 | Evolution 2019 vs 2016 | |

| Languedoc-Roussillon | 6 000 € | 12 700 € | 62 000 € | 2,1% | 5,8% |

| Corsica | 10 000 € | 23 200 € | 50 000 € | 7,8% | 7,9% |

| Loire Valley | 5 000 € | 32 300 € | 320 000 € | 4,0% | 10,2% |

| Rhone valley and Provence | 12 000 € | 49 300 € | 1 300 000 € | 3,2% | 13,6% |

| Bordeaux (Gironde) | 5 000 € | 105 100 € | 4 500 000 € | 3,4% | 1,9% |

| Alsace | 10 000 € | 137 900 € | 665 700 € | 1,5% | 10,9% |

| Burgundy | 10 000 € | 189 200 € | 15 500 000 € | 4,0% | 12,2% |

| Champain | 220 000 € | 1 108 000 € | 1 949 500 € | -1,9% | -0,5% |

Beyond the diversity of prices from one appellation to another, it is the differences in prices and trends within the same appellation that are surprising.

Average vine price in Rhône valley (per hectare) |

|||

| Côtes du Rhône – Appellation régionale | 18 000 € | ||

| Vinsobres | 46 000 € | ||

| Vacqueyras | 100 000 € | ||

| Saint Joseph | 125 000 € | ||

| Crozes Hermitage | 135 000 € | ||

| Gigondas | 200 000 € | ||

| Cornas | 500 000 € | ||

| Chateau Neuf du Pape | 450 000 € | ||

| Côte-Rôtie | 1 150 000 € | ||

|

|||

| Montlouis | 12 000 € | ||

| Cheverny | 12 000 € | ||

| Anjou and Anjou Villages | 17 000 € | ||

| Coteaux du Layon | 20 000 € | ||

| Bourgueil | 20 000 € | ||

| Vouvray | 23 000 € | ||

| Chinon | 23 000 € | ||

| Saint Nicolas de Bourgueil | 50 000 € | ||

| Saumur Champigny | 63 000 € | ||

| Sancerre | 170 000 € | ||

|

|||

| Bordeaux AOP | 15 000 € | ||

| Médoc | 50 000 € | ||

| Haut Médoc | 75 000 € | ||

| Satellites de Saint-Emilion | 95 000 € | ||

| Saint-Emilion | 290 000 € | ||

| Pessac-léognan | 500 000 € | ||

| Saint-Estèphe | 550 000 € | ||

| Margaux | 1 300 000 € | ||

| Pomerol | 1 900 000 € | ||

| Pauillac | 2 300 000 € | ||

|

|||

| Beaujolais & Beaujolais Villages | 12 000 € | ||

| Bourgogne appellation régionale | 32 000 € | ||

| Crus du Beaujolais | 65 000 € | ||

| Petit Chablis | 90 000 € | ||

| Chablis | 175 000 € | ||

| Chablis Premier cru | 400 000 € | ||

| Appellations communales (Côtes de chalonnaise) – blanc | 110 000 € | ||

| Appellations communales (Côtes de chalonnaise) – rouge | 110 000 € | ||

| Appellations communales (Côtes de Beaunes) – rouge | 341 000 € | ||

| Appellations communales (Côtes de Nuits) – rouge | 640 000 € | ||

| Premiers Crus (rouge) | 710 000 € | ||

| Appellations communales (Côtes de Beaunes) – blanc | 775 000 € | ||

| Premiers Crus (blanc) | 1 650 000 € | ||

| Grands Crus | 6 500 000 € | ||

The price of vines in the rest of the world

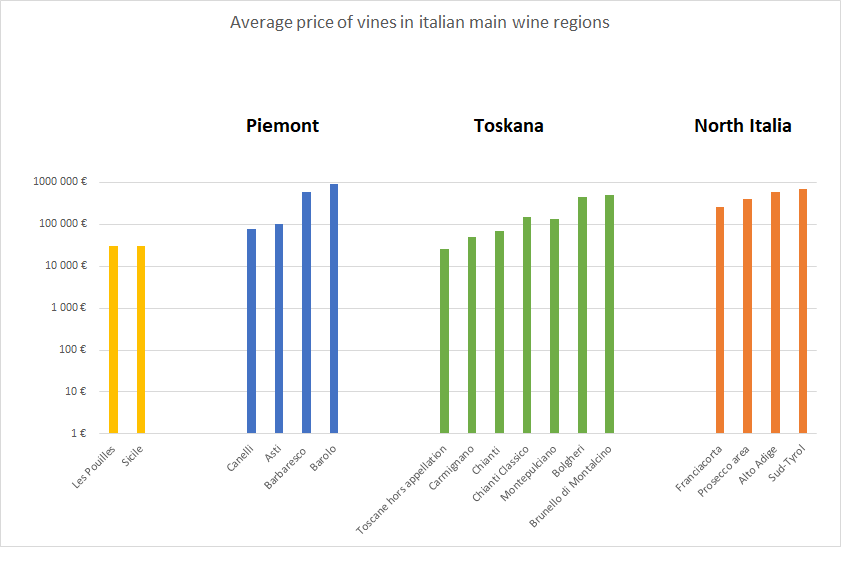

Outside France, data is more scarce. While regularly updated figures can be found in Italy, this is less the case elsewhere in the world. Nevertheless, by compiling several sources of information, it is possible to detect orders of magnitude and fairly precise trends.

The heterogeneity of prices in Italy

In Italy, a hectare of vineyard is traded at an average of €36,000. Here again, the differences are significant, reflecting the heterogeneity of the quality of Italian wines:

- While Sicilian, Sardinian and Apulian vineyards remain affordable (between €10,000 and €30,000), prices can reach €80,000 on the slopes of Mount Etna. The more prestigious vineyards of Piedmont, Tuscany and northern Italy are much more expensive.

- The average price for a hectare of vineyard in the Barolo appellation is €900,000. Prices rise to 1,200,000€ for parcels located on the slopes of the famous Cannubi hill!

- In Tuscany, the Chianti appellation remains affordable (€70,000), but it costs €450,000 for a vineyard in the super Tuscan Blogheri and €500,000 in the Brunello di Montalcino appellation.

- Finally, it is in the north of the country that prices are the most surprising. 400,000 for a hectare of vineyard to produce high quality Prosecco. The demand is strong for the plots of land of the Prosecco producing appellations, driven by a global demand that does not fade. Count 1,200,000 € in the vineyards of Cartizze and Lake Cadaro!

Beware the scale is logarithmic!

Opportunities in Spain

There is little information on the value of Spanish vineyards. Nevertheless, the information we have gathered suggests that vineyards are trading at very reasonable prices. Even in the famous vineyard of Rioja, they would not exceed 70 000€ per hectare on average.

This price level is explained by the abundance of supply. With nearly one million hectares of cultivated vineyards, the Spanish vineyard is the largest in the world! It is ahead of the Chinese, French and Italian vineyards in this ranking.

Rising prices in the great vineyards of the new world

We can see that in the new world, the price of vineyards remains under control. The methods of calculating the value of a plot of land are different from those used in Europe. The most scrutinized values to evaluate the value of a parcel are its productivity (in tons of grapes per hectare) and the value of the harvest on the market (in $ per ton of grapes). One of the direct consequences of this system is the importance of the grape variety planted in the valuation of the parcel. In Napa Valley, for example, Cabernet Sauvignon plots are traded at twice the price of Merlot or Pinot Noir plots. In Sonoma Valley, Pinot Noir parcels are valued more than Zinfandel, Cabernet Sauvignon, Syrah and Pinot Noir. The terroir vs. grape variety divide that separates the wine cultures of the old and new worlds is logically reflected in the valuation of plots!

The reading of these figures shows that the Oregon vineyard presents great opportunities. 180 000€ for a hectare of vineyards in the famous Dundee Hills, that looks like a bargain! Especially when you know the selling price of its pinot noir vintages. This impression is reinforced when you compare them to the price of Burgundy parcels, their cousin in style! This no doubt explains the enthusiasm of the great Burgundian owners for investing in estates in Oregon, like the Drouhin and Jadot families.

If the vineyards of Stellenbosch in South Africa show very heterogeneous prices, one is surprised by the particularly high maximum prices. On the other hand, the Mendoza region in Argentina, where prices generally do not exceed €90,000 per hectare, still seems attractive.

The criteria for the valuation of a vineyard

If the world demand for the wine produced and the visibility offered by the market is of course the main criterion for assessing the value of a vineyard, many parameters modulate this criterion.

- The notoriety of the appellation plays an irrational role in the valuation of a vineyard. Indeed, many international investors are ready to pay a disproportionate price to buy an image rather than a domain. This is the case of a number of Chinese investors who are driving up the prices of the great Bordeaux and Burgundy wines.

- The size of the appellation, which makes the land rare, has an important influence. We have seen this by comparing prices in Bordeaux and Burgundy. For the same value of wine produced, a parcel of land will always be more valuable in Burgundy because the supply is much more scarce.

- The age of the vine, the terroir and the grape variety planted also have a strong influence. In the same appellation, two neighboring vines on the same hillside can be traded at very different prices for these reasons. As we have seen in the new world, the market demand for the planted grape variety determines the price of the vine.

- Finally, as in real estate, the sale of a “free” vineyard is valued better than that of a leased vineyard. In the same way, a lot made up of a vineyard and a building (wine storehouse, castle, residence…) is valued better than a vineyard “alone”.

* 1 hectare = 2,47 acres